Our plans provide access to all the features of the best invoice app. Once you’ve seen how helpful it can be, you can pick the best subscription plan for your business needs. The Invoice Simple App lets you send your first invoice free. Things to Consider When Choosing an Invoice App Invoice Simple is the best invoice app because it allows you to change any of these aspects right from the app.

#QUICK INVOICE SOFTWARE GENERATOR#

Invoice Simple’s invoice generator exceeds expectations by providing a whole host of features you may not have considered. However, you should expect this from most mobile invoicing apps.

Our app allows you to send easy invoices and receive payments instantly.

It also allows you to store information for each client, creating a record of your business and simplifying and expediting any future invoices you wish to create. The app lets you create your own customized invoice with your company’s logo. Our app does, which is one of the reasons our app is rated #1 by customers.

#QUICK INVOICE SOFTWARE FULL#

A mobile invoice app has to have all the functionality of the full invoice software suite. Invoice Simple’s app has all the necessary elements for an invoice app, including many that you probably didn’t know you needed.

#QUICK INVOICE SOFTWARE HOW TO#

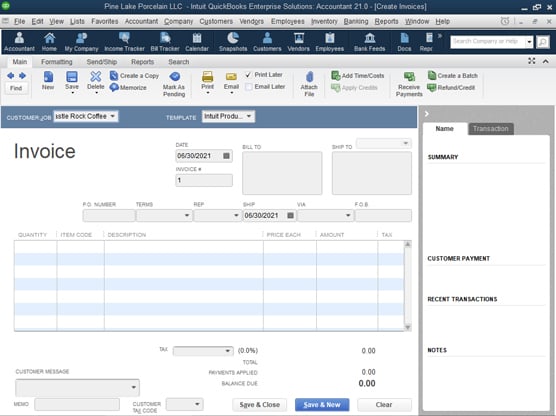

How To Choose The Best Invoice App For Your Business Necessary Elements for a Great Invoicing App Clients expect a quick turnaround time, and with the customization options of the full Invoice Simple platform in the palm of the hand, you are ready to make deals on the go. This is what your customer is required to pay you.With the InvoiceSimple app, you are ready to provide the flexibility that your clients deserve. Total: The total displays the balance due which is calculated from the amount of each line item on the invoice.Notes: Within the notes section of the invoice, you can stipulate any additional terms of service that you've agreed to with your customer.So please consult your local tax resource to determine how much tax you should be applying to your invoices. This rate may differ depending on the geographic location you're business operates in. Tax: Indicating the tax rate applied to the cost of the goods or services provided is legally required on invoices.The line items also require a quantity so the customer knows how many goods or services they are being billed for, the price of the line item and tax rate applied to it, and the amount the line item costs. Line Item: Each line item on an invoice should have a name for the goods or services provided, along with a description of those goods and services.And, since invoices are often due in a specified number of days after receival, the invoice date is important in showcasing when payment is due. Invoice Date: The invoice date indicates when an invoice has been issued which helps your customers if they are receiving multiple invoices from you.Invoice numbers can be formatted in different ways such as file numbers, billing codes or date-based purchase order numbers. Invoice Number: Every invoice has a unique identifier in the form of an invoice number, which helps you keep track of multiple invoices.Bill to: Your customer's business name and address will be displayed within this section, as it indicates who is being invoiced for the receival of goods or services.Your Company Name & Address: The name and address of your company is usually displayed at the top of your invoice in order to differentiate between the company that is providing the goods and services and the company that is receiving them.Description: A description aides in helping your customer understand the nature of the goods and services being invoiced for.This is helpful for when tax time rolls around and for keeping accurate records of your invoices.

0 kommentar(er)

0 kommentar(er)